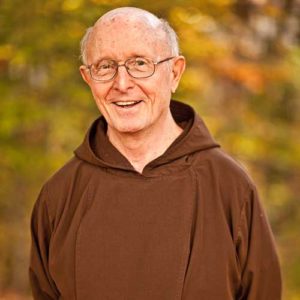

With sadness, we share the news that Fr. Mike Crosby, O.F.M., Cap. has died. In December of 2016, a CT scan and subsequent testing resulted in a diagnosis of cancer of the esophagus. In April, just after Easter, Fr. Mike underwent surgery after a course of radiation treatment and chemotherapy. While the initial prognosis looked positive, another CT scan in June revealed that the cancer had returned with force, and Fr. Mike entered hospice care in Detroit early that month.

Michael Crosby died on 5 August 2017 at the age of 77, after suffering with cancer.

Michael Crosby was born on 16 February 1940, the son of Hugh and Blanche Crosby of Fond du Lac, Wisconsin. He was invested in the Capuchin Order on 31 August 1959, perpetually professed his vows on 1 September 1963, and was ordained on 6 October 1966.

A writer and speaker, Michael was also the executive director of the Seventh Generation Interfaith Coalition for Responsible Investment, which focuses on social ministry and activism through investment. Michael did pastoral ministry at St. Elizabeth Parish (now St. Martin de Porres Parish) in Milwaukee from 1968-1973. From 1973 until his death, Michael ministered in the area of corporate responsibility. Additionally, he was a collaborator for the canonization cause of Capuchin friar Solanus Casey.

Michael is survived by his brother Daniel (also a Capuchin friar), as well as his many Capuchin brothers with whom he lived, prayed and ministered during the past 58 years.

Visitation:

Thurs., Aug 10: St. Bonaventure Monastery, Detroit, 5-8 pm,

with service at 7 pm.

Friday, Aug 11: St. Francis Parish, Milwaukee, 5-8 pm, with service at 7 pm

Liturgy of Christian Burial:

Sat., Aug 12, St. Lawrence Seminary, Mt. Calvary WI; 10:30 am, with viewing beforehand.

Burial in Capuchin cemetery, Mt. Calvary WI

Fr. Mike’s reflections, and those of his brother Fr. Dan, are found on a Caring Bridge site.